Alan Stuart Blinder (born October 14, 1945) is an American economist. He serves at Princeton University as the Gordon S. Rentschler Memorial Professor of Economics and Public Affairs in the Economics Department, and vice chairman of The Observatory Group. He founded Princeton’s Griswold Center for Economic Policy Studies in 1990. Since 1978 he has been a Research Associate of the National Bureau of Economic Research. He is also a co-founder and a vice chairman of the Promontory Interfinancial Network, LLC. He is among the most influential economists in the world according to IDEAS/RePEc, and is "considered one of the great economic minds of his generation."

Blinder served on President Bill Clinton's Council of Economic Advisors (January 1993 - June 1994), and as the Vice Chairman of the Board of Governors of the Federal Reserve System from June 1994 to January 1996. Blinder's recent academic work has focused particularly on monetary policy and central banking, as well as the "offshoring" of jobs, and his writing for lay audiences has been published primarily but not exclusively in New York Times, Washington Post and Wall Street Journal, where he now writes a regular monthly op-ed column. His latest book is After the Music Stopped, published by Penguin in January 2013. He also has been the subject of a recent ethics controversy.

Selected works:

(2013), "After the Music Stopped: The Financial Crisis, the Response, and the Work Ahead," New York: The Penguin Press, 24 Jan. 2013.

(2009), "How Many U.S. Jobs Might Be Offshorable," World Economics, April–June 2009, 10(2): 41-78.

(2009), "Making Monetary Policy by Committee,” International Finance, Summer 2009, 12(2): 171-194.

(2008), "Do Monetary Policy Committees Need Leaders? A Report on an Experiment," American Economic Review (Papers and Proceedings), May 2008, pp. 224–229.

(2006), "Offshoring: The Next Industrial Revolution?" Foreign Affairs", March/April 2006, pp. 113–128. (A longer version with footnotes and references is "Fear of Offshoring," CEPS Working Paper No. 119, December 2005).

(2006), "The Case Against the Case Against Discretionary Fiscal Policy," in R. Kopcke, G. Tootell, and R. Triest (eds.), The Macroeconomics of Fiscal Policy, MIT Press, 2006, forthcoming, pp. 25–61.

(2004), The Quiet Revolution, Yale University Press

(2001, with William Baumol and Edward N. Wolff), Downsizing in America: Reality, Causes, And Consequences, Russell Sage Foundation

(2001, with Janet Yellen), The Fabulous Decade: Macroeconomic Lessons from the 1990s, New York: The Century Foundation Press

(1998, with E. Canetti, D. Lebow, and J. Rudd), Asking About Prices: A New Approach to Understanding Price Stickiness, Russell Sage Foundation

(1998), Central Banking in Theory and Practice, MIT Press

(1991), Growing Together: An Alternative Economic Strategy for the 1990s, Whittle

(1990, ed.), Paying for Productivity, Brookings

(1989), Macroeconomics Under Debate, Harvester-Wheatsheaf

(1989), Inventory Theory and Consumer Behavior, Harvester-Wheatsheaf

(1987), Hard Heads, Soft Hearts: Tough‑Minded Economics for a Just Society, Addison-Wesley

(1983), Economic Opinion, Private Pensions and Public Pensions: Theory and Fact. The University of Michigan

(1979, with William Baumol), Economics: Principles and Policy - textbook

(1979), Economic Policy and the Great Stagflation. New York: Academic Press

(co-edited with Philip Friedman, 1977), Natural Resources, Uncertainty and General Equilibrium Systems: Essays in Memory of Rafael Lusky, New York: Academic Press

(1974), Toward an Economic Theory of Income Distribution, MIT Press

Личен сайт: http://www.princeton.edu/~blinder/editorials.htm

The Future of Europe

The Future of Europe

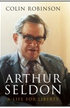

Arthur Seldon: A Life for Liberty

Arthur Seldon: A Life for Liberty